The Credit Card Processing interface allows you to process credit and debit card payments through Millennium, saving the need for a separate card-processing terminal.

Important: You must open a merchant account with Element Payment Services before you can configure the Credit Card Processing interface. Contact Business Solutions for more information.

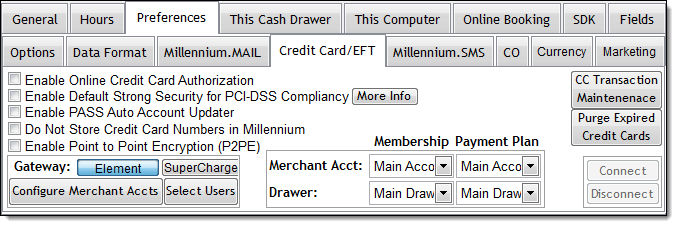

Select Data > Business Information and Preferences.

The Business Information window displays.

The Enable PCI-DSS Security message displays.

Important: When you select Enable Online Credit Card Authorization, Millennium automatically selects Enable Default Strong Security for PCI-DSS Compliancy. Millennium is compliant with the Payment Card Industry Data Security Standard (PCI DSS) when you have Enable Default Strong Security for PCI-DSS Compliancy selected. Click here for more information on PCI DSS compliance.

Note: The Account Updater Service checks for updates to cardholder information to help reduce authorization-related chargebacks and expenses, which is useful if you sell memberships with recurring dues. Contact Element Payment Services for details on how to sign up for the Account Updater Service.

The Merchant Account Setup window displays.

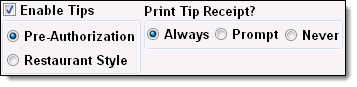

Pre-Authorization = Select to print a tip receipt before a authorizing a card payment so that clients can add a tip for the service provider. When you select this option, you only need one authorization to process a card payment so you pay less per transaction to process card payments.

Select one of the following options to specify when you want to print the tip receipt for a transaction:

Always = Select to always print a separate tip receipt when processing a card payment. The client can then enter the amount of tip to award the service provider(s) on this receipt.

Prompt = Select to display a prompt about printing a tip receipt when processing a card payment.

Never = Select to never print a tip receipt when processing a card payment.

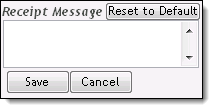

If you selected Always or Prompt, type a message to print on the tip receipt or click Reset to Default to use a standard message.

Restaurant Style = Select to print a tip line on the payment authorization receipt so that clients can enter a tip when they sign for a payment. When you select this option, you need two authorizations (one for the amount due and one for the amount due plus tip) to process a card payment so you pay more per transaction to process card payments.

Important: Contact Element Payment Services for clarification of the fees charged on credit and debit card transactions.

If you do not want to store cardholder data in Millennium, proceed to Step 12.

If you want to store cardholder data in Millennium, proceed to Step 16.

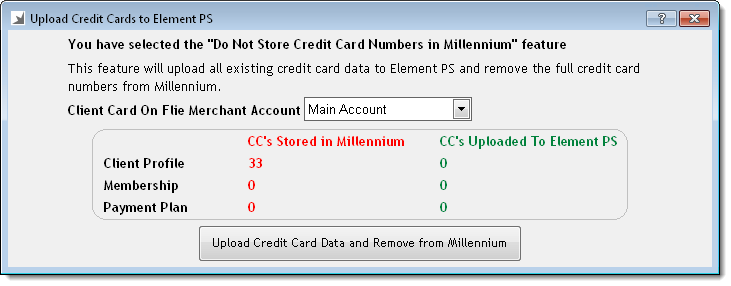

The Upload Credit Cards to Element PS window displays.

The credit card data stored in client profiles and the credit card data for clients with a membership or payment plan uploads to Element's PCI DSS compliant storage facility.

Note: If Millennium could not upload the credit card data for specific clients, you need to correct any errors before the clients' data uploads. Correct any errors and click Upload Credit Card Data and Remove from Millennium once you finish.

Once the upload is complete, Millennium receives an account token for every client. Account tokens contain the last four digits of the card number and the expiration date for the card, and allow you to process credit card payments through Millennium without the need to store sensitive cardholder data in Millennium.

Important: The following restrictions take effect when you select the Do Not Store Credit Card Numbers in Millennium option:

Once you save credit card details in a client's profile, the details upload to Element's PCI DSS compliant storage facility and Millennium receives an account token for the client. This account token allows you use the client's credit card for payment during ring up.

Once you sell a membership with dues payments or open a payment plan account, the cardholder's details upload to Element's PCI DSS compliant storage facility and Millennium receives an account token for the client. This account token allows you to process dues/account payments through Millennium.

When you select to update the credit card used for membership dues/account payments, you can only view the last four digits of the card number and the expiration date for the card currently on file.

You can no longer process offline transactions. You need to process offline transactions when Millennium is unable to establish an internet connection to Element’s online payment processing gateway. Click here for instructions on how to process an offline transaction.

The Automated Credit Authorization Users window displays.

Important: You need Internet access to process card payments.

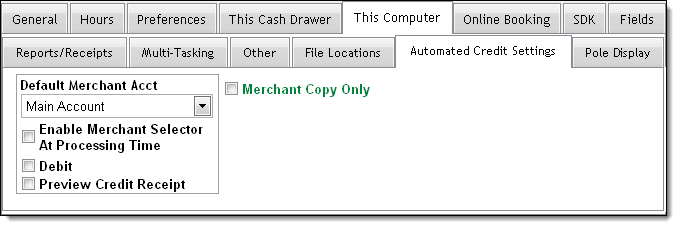

In the Default Merchant Acct field, select the merchant account to use for card transactions processed on this computer.

Select Enable Merchant Selector At Processing Time to allow users to select a specific merchant account when processing a card payment.

Important: You should select this option if you use separate merchant accounts to process the card payments for services provided by booth renters. You can then select the booth renters' merchant account during ring-up.

Select Preview Credit Receipt to display a print preview of the payment authorization receipt during ring up.

Select Merchant Copy Only to only print a merchant copy and not print a customer copy of the receipt for a card payment.

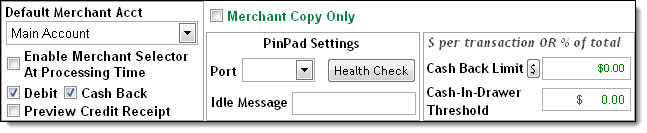

Select Debit if you accept debit cards. If you allow clients to get cash back on a debit card transaction, select Cash Back and complete the following:

Cash Back Limit = Type the maximum amount of cash back allowed on each debit card transaction.

Cash-In-Drawer Threshold = Type the amount of cash in the drawer at which you no longer offer cash back. This setting helps to prevent the cash drawer running out of change and ensures that you can always provide clients with the full cash back amount that they requested.

Notes:

You must complete Steps 18-20 on every workstation where you are going to process card payments.

All users with access to cardholder data must change their login password to a strong password when they next log in to Millennium. Click here for more information on the strong password requirements.